OnlyFans, a content subscription service popular with amateur pornographic models, could face a VAT bill covering more than three years’ worth of uncollected taxes, Sky News has learnt.

The service, which has spiked in popularity during the coronavirus lockdown, functions like a social media platform where fans pay a monthly subscription fee to access content creators’ protected posts.

Last week, for the first time since it began operating in 2016, the service started charging VAT on fans’ monthly subscriptions following discussions with Her Majesty’s Revenue and Customs (HMRC).

Sky News understands HMRC is currently reviewing whether the company should have been collecting VAT since its inception.

HMRC could issue the business with a penalty doubling the amount of tax owed if it assesses OnlyFans was careless or deliberately inaccurate with its returns.

The company stated the review of its tax status was taking place as part of “continuous communication with UK tax authorities”.

OnlyFans says that 80% of its subscription revenue goes directly to the content creators, leaving just 20% to cover “payment processing, hosting, support and all other services”.

If the company is only collecting 20% of its revenues then any VAT, which is charged at 20% or more in all but five states, would account for every penny paid by subscribers in the UK and EU since 2016.

The company said: “Our UK and EU customer base is an extremely important part of OnlyFans, however any potential tax obligation arising from the switch of VAT basis would not have an impact on the continued operations of the business.”

A spokesperson explained to Sky News: “This represents a change of basis for VAT purpose, making OnlyFans the principal on the sale as opposed to the agent.”

“We have previously been paying over VAT on the basis of being an agent,” they added.

They claimed the change was “due to a recent interpretation of an EU law by HMRC”, although did not respond to a request for clarification on what this recent interpretation was.

Experts contacted by Sky News were not aware of any recent changes to how HMRC interprets EU law regarding applying VAT to electronically supplied services.

A spokesperson for HRMC told Sky News: “We are unable to comment on an identifiable business.

“We ensure the tax system is fair for all businesses and that companies are paying all the tax that is due, reflecting the value they get from UK users.”

However, they confirmed that there have been “no recent changes to the VAT rules relating to electronically supplied services and digital platforms”, adding: “Current UK VAT rules correctly reflect EU VAT legislation.”

According to guidance from HMRC, digital platforms which enable third-parties to sell services must be liable to collect VAT and remit it to the department if they authorise the charge to the consumer, the delivery of the service, or if they set the general terms and conditions of the sale.

OnlyFans – which is the trading name for Fenix International Limited, a company registered and based in the UK – does all three.

When fans purchase a subscription on the platform, the money is paid to OnlyFans and they are given access to their chosen creator’s content.

The funds go into an account for the creator, and when creators withdraw those funds into their own bank accounts, they are deposited from an account registered to Fenix International Limited, according to financial statements seen by Sky News.

One creator who started using the platform when the UK entered lockdown due to the COVID-19 pandemic told Sky News the VAT changes were “brought it in overnight with no warning or explanation and no real means of contacting [OnlyFans] to find out what was going on”.

She said she would feel “pretty gutted” if OnlyFans was to cease operating due to the tax liabilities, explaining: “I’ve spent time building my presence and brand on there and have some loyal followers.”

Another creator with the username Miss Zelda told Sky News she uses an accountant to pay taxes on her earnings from OnlyFans and similar sites.

She said: “I add VAT to all my digital services myself (with the help of my accountant). Whether I need to add VAT depends on the country I’m selling to and what sort of thing it is.”

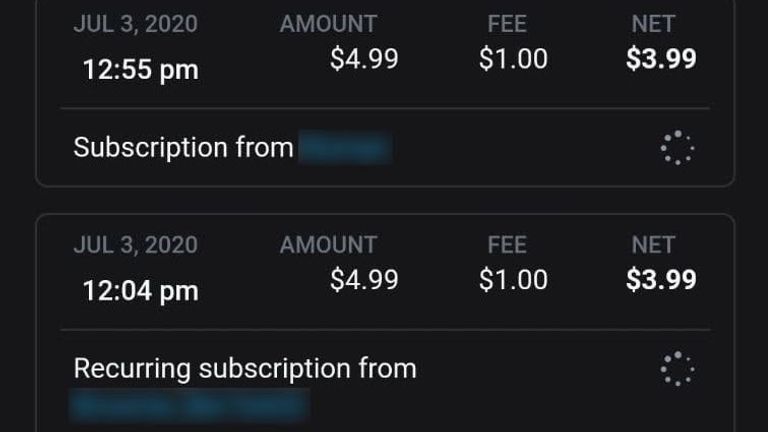

Miss Zelda’s subscribers on OnlyFans are now given a message that they will be charged an additional 20% on her existing fee.

She told Sky News: “My subscription price has stayed the same but my subscribers are being charged more on their end so as a result I’m either going to have to lower my subscription or face a loss in subscribers.”

One rival company which did charge VAT has complained that it was operating at a disadvantage to OnlyFans during this period.

Emilie Moore, of SoSpoilt, told Sky News: “Unlike OnlyFans that waited four years to be HMRC compliant, we designed automatic VAT handling into our platform from the outset to ensure all our creators did not have to worry about potential VAT issues.

“We allow VAT registered creators to submit VAT invoices for payment, and for all others we collect and remit any applicable VAT on content sales.”

If you would like to contact Alexander Martin with a news tip, you can reach him securely using the private messaging app Signal on +44 (0)7970 376 704 or at aj.martin@sky.uk