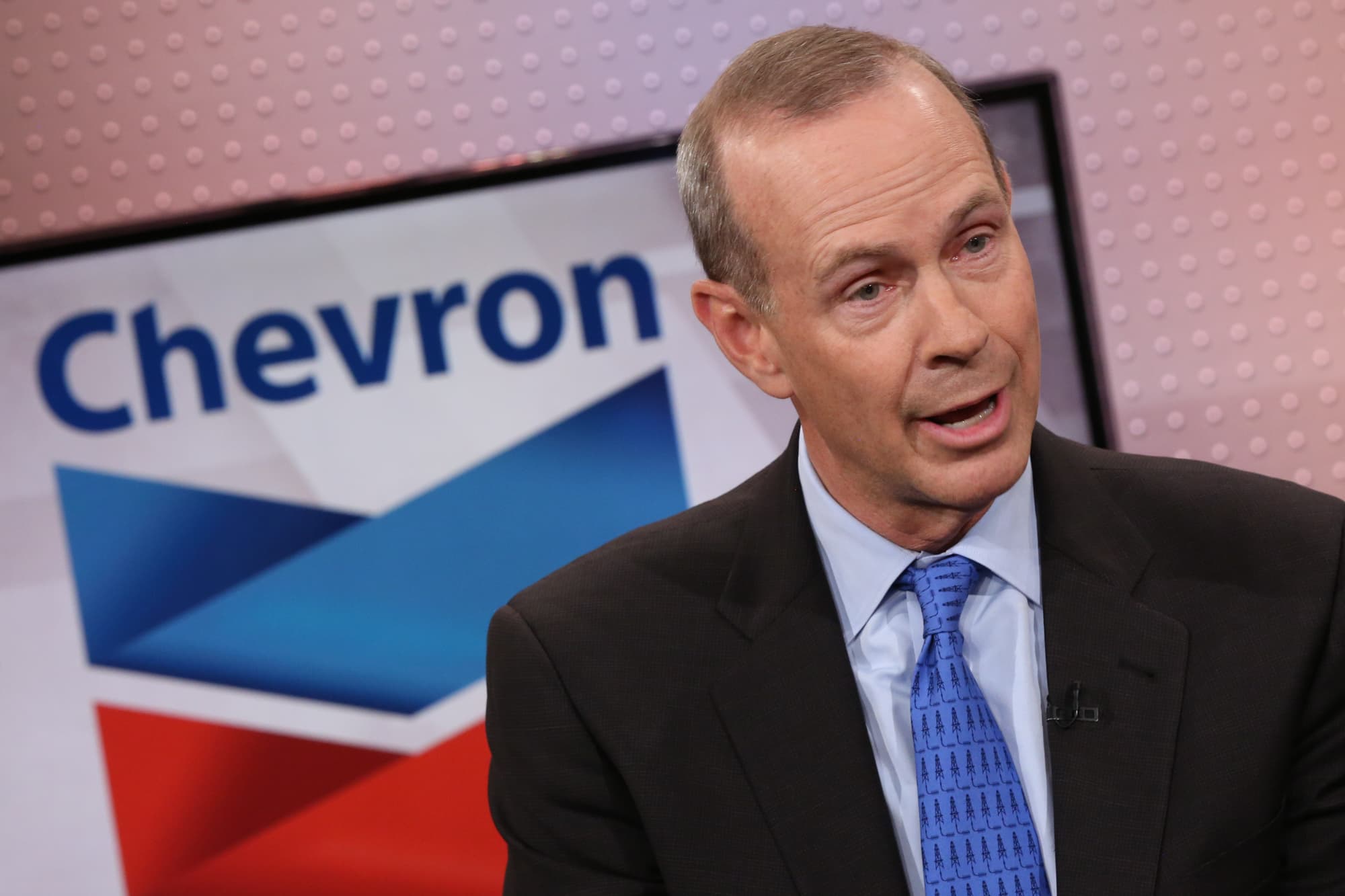

Chevron has taken steps to lessen the oil and gas giant’s dependence on fossil fuels, laying a path to an energy system with a reduced carbon footprint, CEO Mike Wirth told CNBC’s Jim Cramer Wednesday.

“We embrace a lower carbon future. We expect a lower carbon energy system,” Wirth said in a “Mad Money” interview. “The energy system’s always been moving towards lower carbon.”

The comments came in response to a question about money managers who value environmental, social and corporate governance, or ESG, investing. ESG investors look to invest in companies that are focused on the future of energy, leaving little room in their portfolios for companies dealing in traditional energy like fossil fuels or coal.

“The energy system’s always been in transition and we’re investing today,” said Wirth, who explained that Chevron, a top U.S. oil producer, is investing in projects that are “good for shareholders and good for the environment.”

“If we do just invest in things that are good for the shareholders and ignore the environment, that’s not sustainable,” he said. “And if all we do is invest in things that have an environmental case and they don’t create value and returns for shareholders, that’s not sustainable either.”

Chevron is focused on providing high returns for shareholders while lowering carbon emissions, he said. Some of those initiatives, he added, include nuclear fusion, hydrogen and technologies to scale the projects.

In September, Chevron announced a joint venture called CalBioGas LLC, an effort in conjunction with California Bioenergy and local dairy farmers. California Bioenergy deals in converting biomass into clean energy.

The partnership launched renewable natural gas production from dairy farms in Kern County, which is north of Los Angeles.

“We’re actually capturing the waste products from dairy farms now, fermenting those products to create the natural gas product, cleaning it up [and] moving it into a pipeline so it can displace fossil fuels,” Wirth explained. “We reduce methane emissions and we create a salable renewable product.”

Chevron shares fell 1.2% in Wednesday’s session to close at $90.44 per share. The stock is down 25% year to date.