Global stock markets are rallying sharply after positive trial results from a second potential coronavirus vaccine lifted hopes over the battle to defeat the pandemic.

The FTSE 100 jumped by 2%, or more than 100 points, after interim data from a US-developed drug produced by Moderna showed it to be 94.5% effective against COVID-19.

Markets in Europe were also ahead, with France’s Cac 40 and Italy’s MIB recording similar rallies, and New York’s Dow Jones about 1% up in early trading.

The Moderna announcement was a fresh shot in the arm after a positive update from Pfizer last week delivered a big rebound for markets, including for companies – notably in the aviation sector – that have been worst hit by pandemic restrictions.

They were ahead again on the latest trial data – with International Airlines Group, owner of British Airways, Iberia and Aer Lingus, leading the FTSE 100 risers with a gain of 11%.

Aeroplane engine maker Rolls-Royce was up by 9%, while Whitbread, owner of Premier Inn hotels, added 8% and oil giants Royal Dutch Shell and BP climbed 5%.

Elsewhere, Cineworld was up 14%, while Primark owner Associated British Foods climbed 4%.

In New York, Moderna’s shares climbed more than 11% to hit a record high.

Notable FTSE fallers included companies that have seen increased demand during the pandemic, such as online grocery specialist Ocado and restaurant delivery app Just Eat Takeaway – each down 3%.

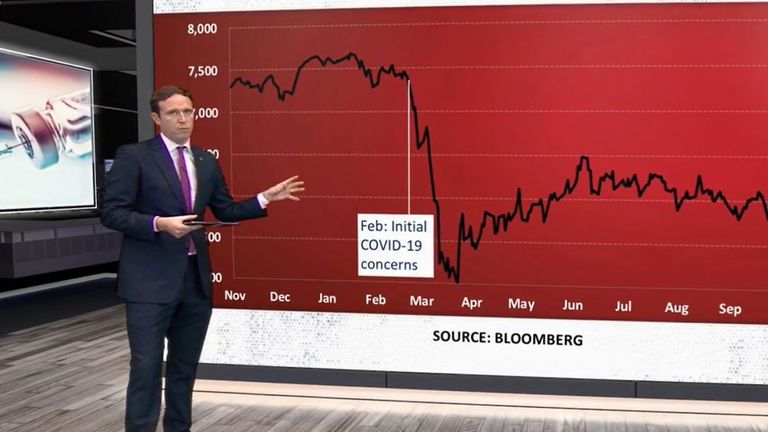

The rebound for the FTSE 100 sees it close in on levels last seen over the summer – since when it has been dragged lower by worries about a second wave of cases and further lockdowns.

Commenting on the significance of the Moderna results, analysts at Shore Capital highlighted the finding that it could be stored for up to 30 days in household refrigerators – whereas the Pfizer vaccine must be stored at -70C.

“This is a very significant development from Moderna and will greatly simplify the vast logistical effort that will be required to coordinate this mass vaccination campaign,” the analysts said.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “Another big dose of positive vaccine news has sent the FTSE 100 soaring as investors see the light at the end of the coronavirus tunnel shining even brighter.

“This is early data and the Moderna vaccine isn’t likely to be approved for at least another few weeks but the announcement adds to the confidence washing through the financial markets.”

Michael Hewson, chief market analyst at CMC Markets, said: “The more companies that can develop a vaccine candidate that can be shown to be effective, the more optimistic investors will be about being able to see a way out of this pandemic.”

Restrictions imposed by governments to curtail the spread of the virus have crushed economic activity with retail, hospitality and aviation the worst hit sectors according to a Sky News tracker of job losses during the pandemic.

The UK suffered its worst-recession on record in the first half of the year as the initial lockdown took its toll.

Figures last week showed a sharp bounce-back in GDP for the third quarter, but also revealed that the pace of recovery was slowing even before the latest lockdown in England – which is expected to send the economy back into reverse for the end of the year.

They also showed that the UK has been slower to recover than other economies such as the US, with Britain’s GDP at the end of the period still 9.7% lower than it was in December 2019.

The impact on jobs has also been stark, and looking likely to worsen, with a record number of redundancies across the UK in the July to September period.